Before you dig the first spade of earth on the way to the company apartment, it is necessary to find out enough about the different types of rental agreements, the tax pitfalls and other tips and tricks.

This article gives you an initial overview of what companies need to look out for before they can secure a better reputation as a social enterprise, opportunities for returns through renting apartments and greater attractiveness for skilled workers by building company housing.

the essentials in brief

- A company apartment is usually spoken of when the rental is secured by a contract for a company rental apartment in accordance with Section 576 of the German Civil Code.

- When renting a company apartment, German tenancy law applies.

- The rental prices for a company apartment are based on the usual local comparative rents. A concession does not make sense for tax reasons.

- Targeted changes in the law are intended to improve the framework conditions for company housing in the future and create additional financial incentives for companies.

Rental

The basic rule is: German tenancy law also applies in full to rentals between employer and employee. Specifically, a distinction is made between four contracts that come into question for renting company apartments. In addition to letting for temporary use and the qualified temporary rental contract, the contract as a work rental apartment/service rental apartment and the contract for service apartments are used.

Work rental apartment or service rental apartment

This type of rental is regulated by paragraph §576 in the German Civil Code (BGB). It is specially tailored to company housing. This contract can only be concluded under the condition that the tenant and landlord are in an employment relationship. If one speaks of company apartments, this type of contract is usually meant.

A normal work rental apartment is an unbound apartment. This means that, unlike in a caretaker’s or porter’s apartment, the tenant lives in the apartment because of his work, but his work has nothing to do with the apartment.

As with all tenancies, current tenancy law applies to this tenancy agreement. However, the landlord can terminate the contract earlier if the employment relationship between him and the tenant has ended.

Rental for temporary use: BGB §

This rental is a short-term special need, for example if the employee is in town for a week at a trade fair or conference and lives in the company apartment for this short time. The usual rent increase regulations and protection against dismissal do not apply in this case.

The following applies to rent: A tenant who lives in a company rented apartment pays rent as normal. For tax reasons (see below), the rent for a company apartment is based on the local comparative rent. A rent increase is therefore also possible in accordance with the applicable tenancy law.

Work service apartment or service apartment

The rental of a service apartment is defined by paragraph §576b of the German Civil Code (BGB). With this variant, there is no separate rental agreement, but the rental is linked to the employment contract. Because the provision of the apartment is the payment – or part of the payment – for the service. Consequently, no rent is paid with this contract variant. The employee works, and in return he can live in the company apartment “for free”. In the case of the company apartment, the tenancy ends immediately with the termination of the employment relationship.

The net cold rent in major German cities was up to 15.48 euros/m2 in the first quarter of 2016 (Munich)

Attention: taxes!

In terms of tax law, the company apartment has a serious disadvantage: the monetary advantage. According to a current study by the Pestel Institute, 400,000 apartments will have to be built every year over the next five years to meet the housing demand. The idea of not only enticing the employee with the promise of a vacant apartment, but also offering them a cheap rental contract is obvious. However, a reduced rent can quickly be interpreted as a pecuniary advantage for the employee. According to German tax law, they then have to pay a high tax contribution. This means that the tenant does not get off better despite the actually cheap rent: what he saves in rent, he has to pay in taxes.

The monetary advantage occurs when there is too great a difference between the rent for the company apartment and the usual local rent. This is independent of whether the apartment belongs to the employer, whether it is on his property or whether he has rented it.

So the following applies in all cases: Heavily discounted rents do not make sense! Instead, one should orientate oneself to the local comparative rent.

Institutions such as the tenants’ association or IG BAU are therefore striving for a change in the law. A special exemption is planned, which will still make cheaper rental possible. The company housing model is to be strengthened in order to ease the strained housing market.

But you can already take advantage of tax advantages when building a company apartment: Since the company apartment is also an investment, the purchase of a plot of land as well as the purchase or construction of a property can be tax deductible.

And as the landlord of a company apartment, like any landlord, you enjoy a number of tax advantages: the property tax can be claimed in full. Incidental costs such as furniture purchases, renovations and repairs are all tax deductible. Likewise, office costs, as well as lawyer and tax consultant. So there are numerous ways to save on taxes with a company apartment.

Company apartment in concrete terms: What you have to pay attention to

If you decide to give your company a special appeal by offering company housing, there are a few things you need to consider.[ads-pullquote-left]Re-letting and new letting rents increased by 3.5% from 2014 to 2015.[/ads-pullquote-left] In addition to the various rental agreements and tax snags, there are also a few practical points that need to be dealt with before the project can be fleshed out:

Fundamental is a suitable building area. It must first be ensured that this area can be used for long-term living. Attention: commercial areas are fundamentally unsuitable because living in the commercial area is prohibited, apart from rare exceptional cases.

Furthermore, there are a few things to be clarified about the construction before swinging the shovel. On the one hand, care must be taken to ensure that the construction is in line with the municipal land use planning. Depending on the location, there are stricter (this can go as far as the color of your house) or less strict conditions that you have to meet.

But in addition to the municipal conditions, the needs of the future tenants must of course also be taken into account. An advantage here is that there is already a concrete idea of the future tenant, to whose needs the apartment can be optimally adapted. Because he will drive to work every day, the proximity to the company should be taken into account, for example. But the family planning of the employees can also be taken into account when designing the apartments. It also makes sense to focus on the needs of tenants in general. In this way, the company keeps the option open of renting the apartments to non-employees. Quiet, light and location are always additional incentives for tenants.

In addition to space and construction, you should also ask yourself what costs and, above all, what time expenditure you will face with this project. The company apartment cannot and should not be a substitute for the core business! Neither planning, construction nor administration may take up so much of the operation that it neglects its core business. If you are a small company that has no previous experience with housing construction and management, you can also outsource the project to an external company. This gives you the opportunity to continue concentrating on your core business. You can vary how much influence and risk you want to give up.

The role of company housing in the future

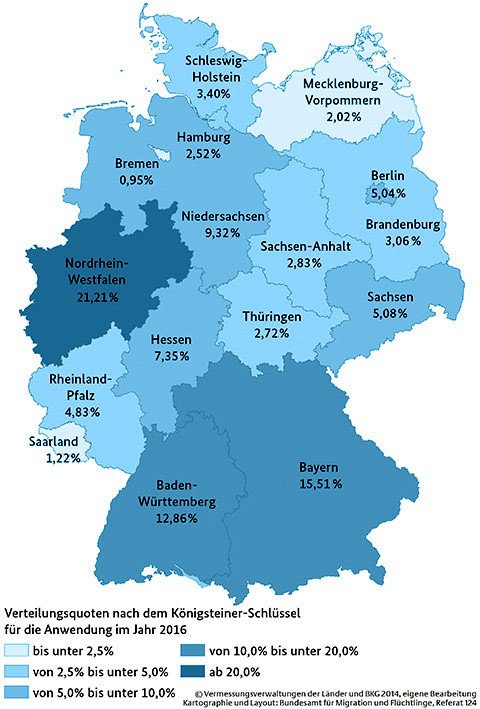

The employee housing of the future should make a contribution against the acute housing shortage. The completion result must be increased annually by around 140,000 rental apartments + 80,000 social housing + 60,000 housing units in affordable housing construction until 2020. In order for large and small companies to face up to this task and responsibility, more favorable conditions for employee housing should be created. Specifically, three changes in the law are being sought:

- The company apartment should be available to the employee more cheaply. So far, this has not made sense, since the employee does not benefit from the cheaper rent due to a monetary advantage, but instead has to pay more taxes. Therefore, an allowance of approx. 100-150€ should be made possible.

- Most companies do not have suitable land available. Although they have plots of land in a good location, these do not correspond to the usage rights, for example because they are located in an industrial area. Therefore, it is demanded that the current building rights are adjusted. This should make it easier for companies to use the space available to them for company housing.

- Living in company apartments is particularly interesting for households with lower incomes. The companies create social living space by building employee housing. For this reason, company housing should be specifically integrated into social housing promotion. This should result in tax incentives for companies.

This article gives you an initial overview of the concrete and abstract decisions you have to make before actually building a company apartment.

Other parts of this series

- Company housing part I – what they were then and what they could be today

- Company housing part II – The company housing today – tips and tricks in the legal jungle

- Company apartments Part III – Employee apartments – A tried and tested concept is becoming a trend again!