cost of buying the property

broker commission

If a real estate agent was involved in the purchase of your property, they will charge a broker’s commission on the purchase price. It doesn’t matter whether you hire a broker to look for a suitable property or whether the seller has hired him. Because be careful: unlike for rental property, the ordering principle does not apply to real estate purchases. The maximum amount of the broker’s commission is also not regulated by law, but only traditionally determined. Depending on the region, the broker’s commission varies between 3% and 7.14% of the purchase price. The individual federal states handle this differently as to whether the buyer pays the agent’s fee alone or whether the buyer and seller split the sum. In Berlin and Brandenburg, for example, a brokerage fee of 7.14% is common, which is paid in full by the property buyer, while in Bavaria the same amount is common but shared between buyer and seller. But nowhere do sellers pay less than 3.57% on average, even in Mecklenburg-Western Pomerania, where the commission is lower and shared. You can always find the exact price in the exposé of the broker. Nevertheless, this broker’s commission can have a significant impact on the amount of ancillary costs, especially with today’s property prices.

Almondia Tip: Negotiate the commission with your agent. In Germany there is no uniform regulation on the maximum limit of the broker’s commission. The intermediaries are usually based on the local commissions. Once you have agreed on a value with your broker, put it in writing before you start looking for a property.

real estate transfer tax

The Treasury also wants a piece of the cake if you buy a piece of land. Depending on the federal state, you have to pay 3.5 to 6.5% of the purchase price as real estate transfer tax before you can be entered in the land register as the owner. Berlin (6%) and Brandenburg (6.5%) are among the federal states with high real estate transfer taxes. This example also makes it clear that the tax is decoupled from the scarcity of the good. Whether the buyer or the seller has to pay the real estate transfer tax is to be contractually agreed, but it is usually paid by the buyer.

Land register and notary costs

Once you have transferred the purchase price and handed over the keys, you cannot legally call yourself a homeowner. In Germany, owning a property requires the new owner to be entered in the land register. The purchase contract for a property only becomes legally binding once it has been entered in the land register and authenticated by a notary. The total amount of the land register and notary costs is difficult to estimate in advance, since the specific amount depends on the purchase price. The fees are set out in the Court and Notary Costs Act (GNotKG) and amount to up to 1.5% of the purchase price. These 1.5% of the property price are added to the ancillary construction costs.

If you use construction financing to build or buy a house, the lending bank must enter security in the land register – the so-called land charge order. A notary has to do this again and takes about 0.35% of the mortgage amount, i.e. the amount of the loan. It may be necessary to make further entries in the land register that are subject to a fee, such as rights of way and rights of residence or the deletion of existing encumbrances.

When buying real estate, a notary is necessary as an impartial authority and contact person for all legal questions for buyers and sellers. A notary has various tasks: He draws up the purchase contract and certifies the signature of both parties. This is required by law to ensure that the contract is legally secure for both parties.

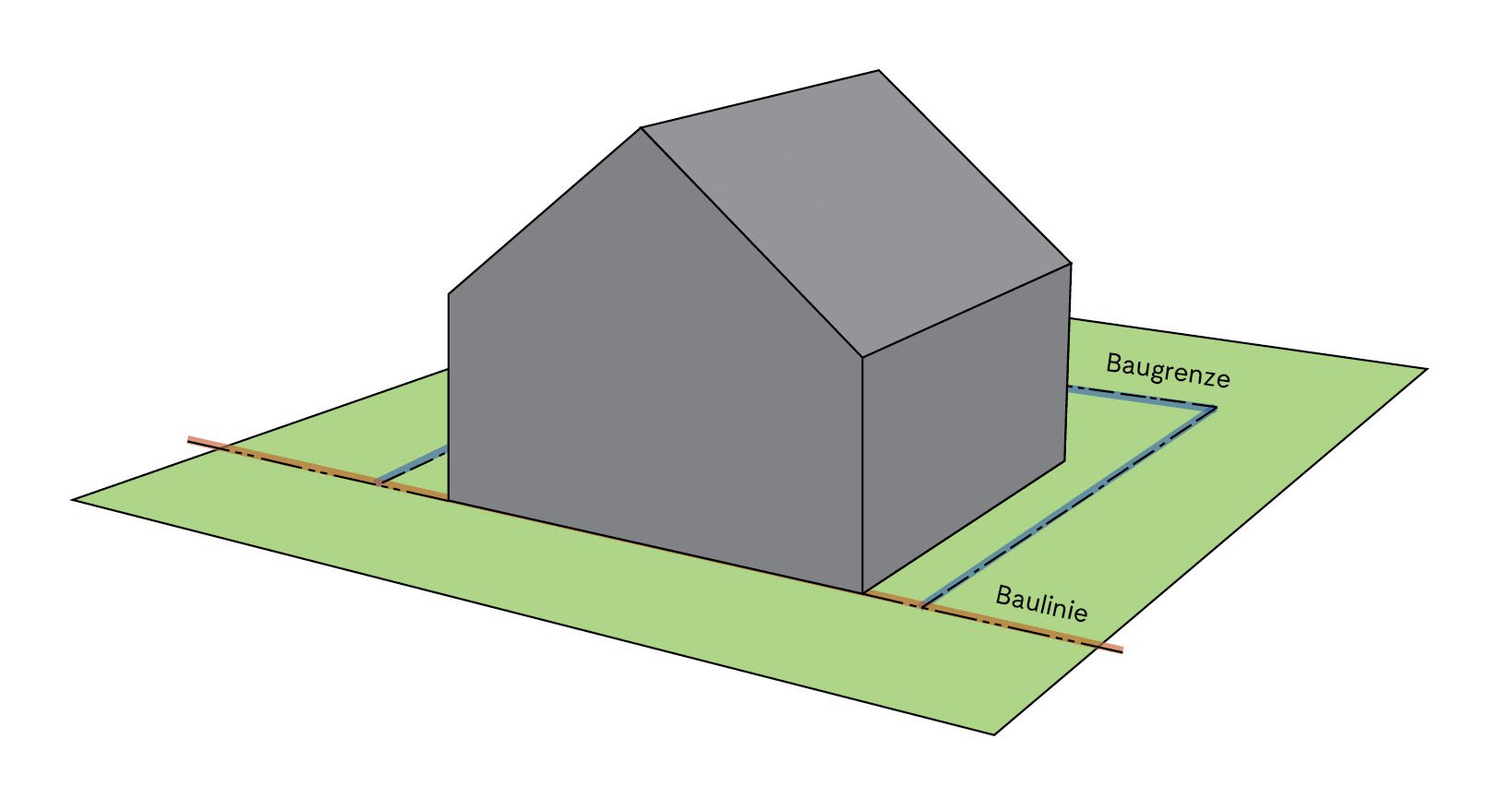

building permit

Once the property has been bought and the planning has been completed by the architect, a building application can be submitted. This is a prerequisite for obtaining a building permit. Since the costs are determined and collected by the municipalities, this point is not easy to calculate either. The costs for a building permit are calculated on the basis of the enclosed space, the construction value per m³ and additional buildings and facilities (e.g. garages and heat pumps) multiplied by the corresponding fee rate of the municipality. In principle, 0.4-0.5% of the total construction costs can be expected for a single-family house. For a €200,000 family home, the costs should not exceed €1,000.

Pre-construction services

Architect’s cost

If you want to plan your house individually, there are costs for the architect. The architect’s fee is calculated on the basis of the fee schedule for architects and engineers (HOAI), which sets minimum and maximum rates. These are percentages, so the actual sum is in relation to the total construction costs.

Review of the construction contract

Construction contracts are often difficult to understand for laypeople. Infinitely long sentences, nested if-then formulations and numerous exceptions make reading and especially understanding such a contract text anything but easy. But it is not just the examination of the actual text of the contract that is important, the description of services is of particular relevance. We have put together the most important pitfalls in the construction contract for you so that you can get an initial overview yourself. Nevertheless, we strongly advise having the legal review of the construction contract carried out by a professional.

The service description contains all benefits in kind that are included in a work or purchase contract. If you are not an expert when it comes to house construction and building law, it is essential that you have both the building contract and the specifications checked by a specialist lawyer, the building owners’ protection association or an experienced building supervisor! Because if you don’t know exactly what is in these two documents, you are taking an incalculable risk and will not have any leverage in the event of a legal dispute. The costs for checking the text of the contract, including the description of services, amount to between 200 and 500 euros.

Table: additional costs before the house is built

| type of construction costs | Amount of the additional construction costs |

| Broker commission for the property search | 3 to 7.14% of the purchase price, depending on the state |

| real estate transfer tax | 3.5 to 6.5% of the purchase price of the property (depending on the state) |

| land register costs | approx. 1.5% of the purchase price of the property |

| notary fees | approx. 1.5% of the purchase price of the property |

| land charge order | approx. 0.35% of the mortgage amount |

| building permit | 0.4 to 0.5% of the construction sum (depending on the fee ordinance of the federal state) |

| Review of the construction contract | 200 to 500 euros / free for Almondia customers |

Other articles in this series: ancillary construction costs for setting up the construction site , ancillary construction costs checklist with prices during the construction phase or the large ancillary construction costs checklist