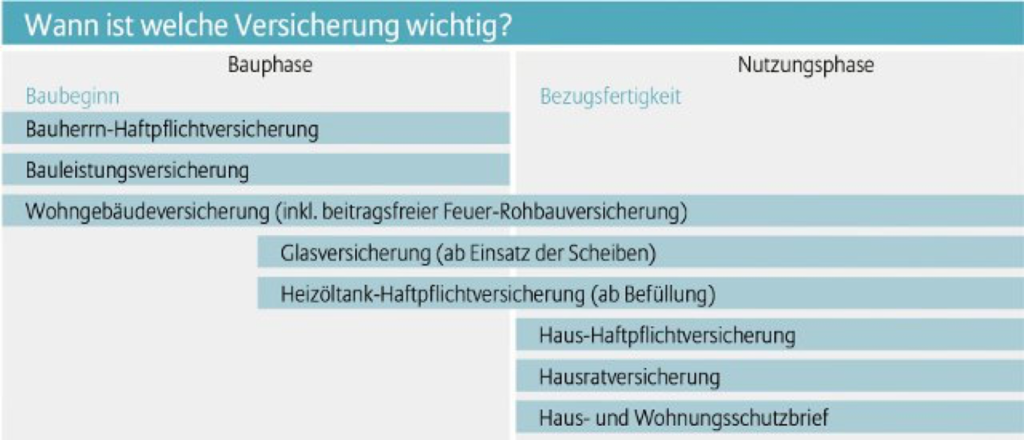

An important factor without which the dream of owning a home can quickly turn into a nightmare is a comprehensive construction concept that covers all eventualities. With the support of the construction insurance professional Lennart Christoph Joos, we have summarized the most important insurances for your house construction project.

the essentials in brief

Fire shell insurance protects builders and contractors against fire, lightning strikes and explosions during the construction phase.Construction insurance protects builders and contractors from damage that occurs unforeseeably during the construction period.

Builder’s liability insurance offers insurance protection against statutory liability claims due to the violation of traffic safety obligations .

Since building your own home is one of the most expensive investments in life for many, it pays to make every decision with care and to calculate the risks precisely. However, you should not save at the wrong end, after all, your financial security is at stake. Unforeseen incidents can cost a lot of time, money and nerves and, in the worst case, even endanger the entire construction project. Above all, protection against the financial consequences in the event that someone is injured is essential. Comprehensive insurance protection, which equips you against all eventualities right from the start, prevents you from having to dig deep into your pockets later.

fire shell insurance

Fire shell insurance is particularly recommended and often required by many credit institutions to grant financing loans. This insures against the risk that your shell will burn down in whole or in part, for example after flying sparks during welding work. The consequences of a lightning strike or explosions are also insured. Fire shell insurance can also cover heat-related damage to building materials stored on site.

After fire damage, fire shell insurance also provides support with regard to the costs of clean-up work, securing the site of the damage, public permits and replacement purchases.

Fire shell insurance is often premium-free for a certain period of time if you take out real estate or residential building insurance with the same insurance company for the period after completion of the building.

construction insurance

Statistically, there is a case of damage for every second house built. Construction insurance protects builders and contractors (including those responsible and employees of all companies involved in construction) from damage that occurs unforeseen during the construction period. Examples of this are impairments as a result of severe storms, but also additional costs due to design, material and workmanship errors. Construction insurance is also liable in the event of theft of materials that are permanently attached to the building, as well as glass breakage as long as the glass has not yet been installed. The costs for the restoration as well as for the necessary clean-up work are covered. Auxiliary structures, auxiliary construction materials, subsoil and soil masses as well as costs for damage detection are also covered up to a certain amount.

With construction insurance, it doesn’t matter who caused the damage. This saves you unpleasant arguments about who is responsible and who is to blame, and you can have any damage repaired immediately.

Builder liability insurance

The builder’s liability is so extensive that even putting up a sign saying “Do not enter the construction site – parents are liable for their children” does not exonerate them. If, for example, a child falls into an insufficiently secured excavation pit while playing on the construction site, you as the builder must bear some or even all of the resulting personal injury and damage to property.

If necessary, builder’s liability insurance covers treatment costs and compensation for pain and suffering as a result of an accident on the construction site. In addition to the assumption of personal injury, the builder’s liability insurance also covers material costs (e.g. repair or replacement costs) and financial losses as a result of personal injury or property damage (e.g. loss of earnings, loss of use or lost profit).

Other insurances

Even after the completion of the construction work, the need for insurance cover does not stop. After the construction phase, the shell and fire insurance can be converted into residential building insurance, which supplements the previous protection with coverage against damage caused by mains water, storms, hail and also natural hazards. It also makes sense to take out glass insurance, which replaces window panes and glass components inside the house. House liability insurance and above all household contents insurance can also be useful for homeowners. Household contents insurance always covers the new price for damage that occurs to your household contents, i.e. to your entire inventory of movable objects in your property. There are a variety of insurance providers offering different rates for home insurance. Household contents insurance usually covers all damage caused by a wide variety of events such as fire, burglary or water. In the case of oil heating systems, it is also strongly recommended that you take out heating oil tank liability insurance to protect against damage caused by leaking heating oil. As a builder, you are liable for such damage to the environment even if you are not at fault for the accident. The heating oil tank liability insurance covers the costs of damage to the house and property, such as the renovation of the masonry, the dredging of contaminated soil and its disposal, refilling with soil and new planting. In some cases, even a replacement filling of the heating oil tank is taken over.